Why traders still pick MT4 over newer platforms

MetaQuotes stopped issuing new MT4 licences some time ago, steering brokers toward MT5. Yet most retail forex traders stayed put. The reason is simple: MT4 does one thing well. A huge library of custom indicators, Expert Advisors, and community scripts run on MT4. Moving to MT5 means rebuilding that entire library, and few people would rather keep trading than recoding.

I've tested both platforms side by side, and the gap is smaller than you'd expect. MT5 has a few extras like more timeframes and a built-in economic calendar, but the charting feels nearly identical. If you're weighing up the two, there's no compelling reason to switch.

Getting MT4 configured properly the first time

Downloading and installing MT4 is the easy part. What actually causes problems is configuration. Out of the box, MT4 shows four charts squeezed onto one window. Clear the lot and start fresh with the markets you care about.

Chart templates save time. Set up your usual indicators on one chart, then save it as a template. After that you can load it onto other charts without redoing the work. Small thing, but over time it makes a difference.

One setting worth changing: go to Tools > Options > Charts and tick "Show ask line." MT4 only shows the bid price by default, which can make entries appear wrong until you realise the ask price is hidden.

How reliable is MT4 backtesting?

MT4 comes with a backtester that lets you run Expert Advisors against historical data. Worth noting though: the reliability of those results hinges on your tick data. Built-in history data is modelled, meaning gaps between real data points are estimated with made-up prices. For anything that needs accuracy, you need real tick data from a provider like Dukascopy.

The "modelling quality" percentage is more important than the profit figure. Below 90% suggests the results shouldn't be taken seriously. People occasionally show off backtests with 25% modelling quality and wonder why their live results don't match.

Backtesting is where MT4 earns its reputation, but only if you feed it decent data.

MT4 indicators beyond the defaults

MT4 ships with 30 default technical indicators. Few people use more than five or six. However the real depth comes from user-built indicators written in MQL4. The MQL5 marketplace alone has thousands available, covering everything from tweaked versions of standard tools to complex multi-timeframe dashboards.

Installing them is straightforward: copy the .ex4 or .mq4 file into the MQL4/Indicators folder, refresh MT4, and the indicator shows up in the Navigator panel. One thing to watch is quality. Community indicators range from excellent to broken. Some are genuinely useful. Others are abandoned projects and will crash your terminal.

When adding third-party indicators, check the last update date and whether people in the forums report issues. Bad code doesn't only show wrong data — it can slow down the whole terminal.

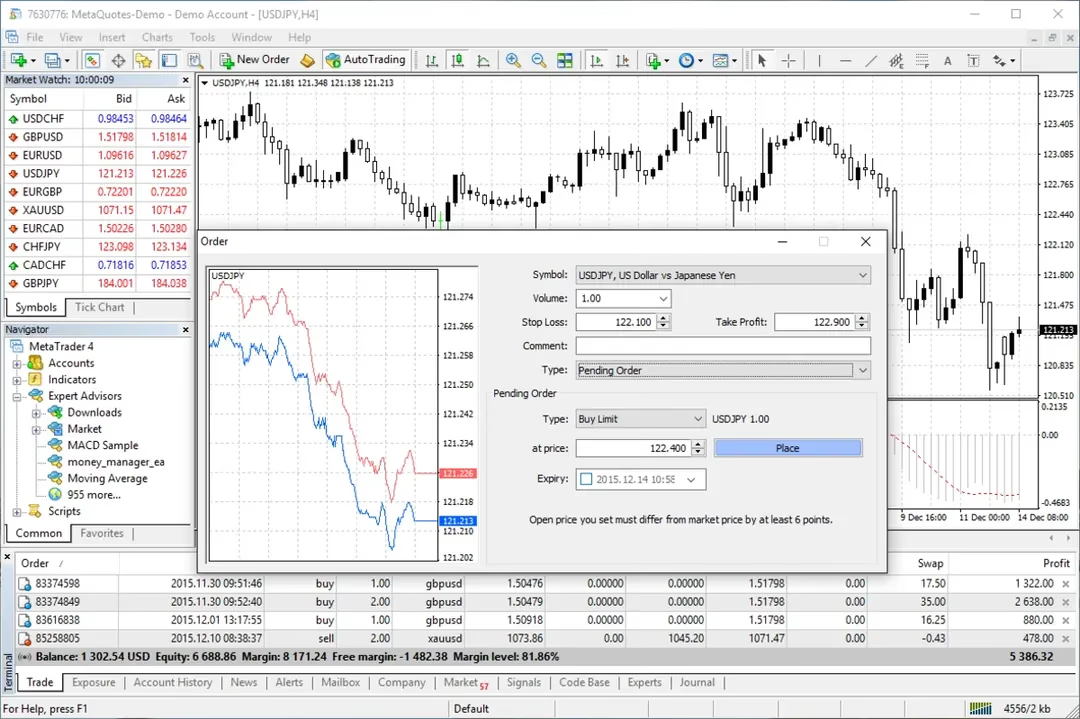

Managing risk properly inside MT4

MT4 has a few native risk management features that a lot of people skip over. The most useful is the maximum deviation setting in the new order panel. It sets the amount of slippage you'll accept on market orders. Leave it at zero and you'll get whatever price is available.

Everyone knows about stop losses, but trailing stops is overlooked. Right-click an open trade, select Trailing Stop, and define your preferred distance. Your stop loss moves when price moves in your favour. Doesn't work well in choppy markets, but on trending pairs it reduces the need to stare at the additional information screen.

These settings take a minute to configure and they remove a lot of the emotional decision-making.

Running Expert Advisors: practical expectations

EAs sounds appealing: program your strategy and stop staring at charts. In practice, most EAs fail to deliver over any extended time period. EAs sold with flawless equity curves are often fitted to past data — they worked on past prices and break down when market conditions change.

None of this means all EAs are a waste of time. Some traders code custom EAs for specific, narrow tasks: time-based entries, managing position sizing, or closing trades at fixed levels. These utility-type EAs are more reliable because they do defined operations without needing judgment.

If you're evaluating EAs, use a demo account for a minimum of two to three months. Live demo testing tells you more than backtesting alone.

MT4 beyond the desktop

MT4 is a Windows application at heart. If you're on macOS deal with compromises. Previously was running it through Wine, which mostly worked but introduced visual bugs and the odd crash. Some brokers now offer macOS versions built on Wine under the hood, which is an improvement but remain wrappers at the end of the day.

The mobile apps, available for both iPhone and Android, are surprisingly capable for monitoring positions and managing trades on the move. Serious charting work on a mobile device doesn't really work, but adjusting a stop loss from your phone is worth having.

It's worth confirming if your broker provides a native Mac build or just a wrapper — the experience varies a lot between the two.